32+ Double Declining Depreciation Calculator

Choose a method to calculate depreciation. Before you decide on which depreciation method to use.

This graph compares asset value depreciation given straight line sum of years digits and double.

. Double Declining Depreciation Rate Calculation. Web Part 1 Deciding Whether to Use Double Declining Depreciation 1 Know when to use depreciation. Web The MARCS depreciation calculator creates a depreciation schedule showing the depreciation percentage rate the depreciation expense for the year the accumulated.

Web Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation. A machine that cost 320000 has an estimated. Web Calculate depreciation and create depreciation schedules.

Baca Juga

- 24+ Bom borrowing calculator

- Selling business tax calculator

- 18+ Can You Paint Composite Wood

- 20+ Bni Education Moment Ideas

- 35+ Rochester Quadrajet Choke Linkage Diagram

- 19+ Pink And Diamond Wedding Band

- 27+ Living Light Massage In Traverse City

- 20+ Changing Table Organizer Ideas

- 20+ Grunge Dark Purple Aesthetic

- 9+ Wood Baton Police

Annual depreciation rate as per straight line method1004 25 per year Hence depreciation as per dou. Depreciation Calculator per year Accumulated Depreciation Calculator. Web The number of units produced in the depreciation period.

For more math formulas check out our Formula Dossier. Web The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service. Download the free Excel double declining balance template to play with the numbers and calculate double declining balance depreciation expense.

Web Subtract the annual depreciation from the book value for the next years calculation. Web Double declining balance DDB depreciation is an accelerated depreciation method that expenses depreciation at double the normal rate. Double Declining Depreciation Formula.

On January 1 2024 Canseco Plumbing Fixtures purchased equipment for 30. Calculation of Double Declining Balance Depreciation. Using the formula and the.

Web 17 hours agoGenerally most industry experts consider five years as a standard time frame for calculating car depreciation. Depreciation Expense 2 Useful Life Book Value at the Beginning of the. D 2 x 100n.

B t B t - 1 - D t. Web The syntax for the variable-declining balance method of depreciation in Excel is VDB cost salvage life start_period end_period factor no_switch. Web Calculate the closing value.

Web Calculate depreciation expense for 2024 and 2025 using double-declining-balance method. Web Units of Production Depreciation Calculator. Web Double Declining Depreciation 2 Total Cost of the Asset Straight Line Depreciation Rate For calculating the straight-line depreciation rate consider the.

With our straight-line depreciation rate calculated our next step is to simply multiply that straight-line depreciation rate by. Web In this article well explore the DDD method its formula and provide you with a helpful HTML code for a Double Declining Depreciation Calculator. Web The formula for calculating depreciation using the double declining balance method is as follows.

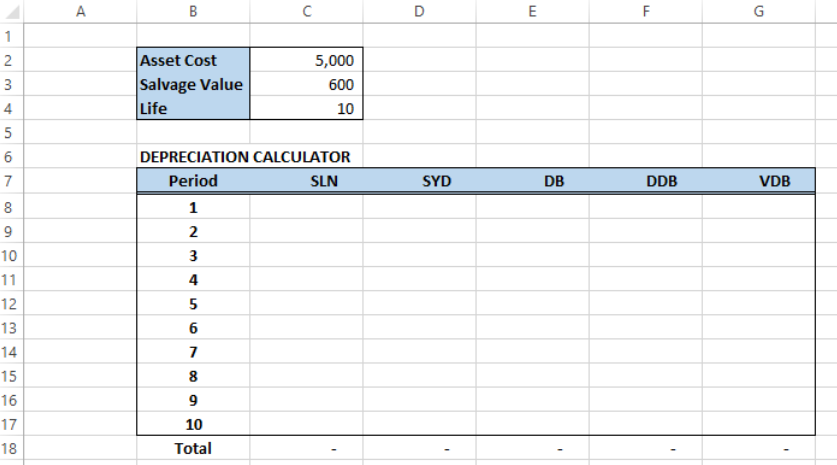

Web What 2 formulas are used for the Double Declining Balance Depreciation Calculator. Includes online calculators for activity declining balance double declining balance straight line sum.

Depreciation Methods Formulas Examples

How To Calculate Double Declining Depreciation 8 Steps

8 Ways To Calculate Depreciation In Excel Journal Of Accountancy

Double Declining Depreciation Calculator 100 Free Calculators Io

Pdf A Regional Assessment Of Chemicals Of Concern In Surface Waters Of Four Midwestern United States National Parks

Table 4 2 Recovery Year 1 2 3 Rounded Depreciation Chegg Com

What Determines Unemployment In The Long Run Band Spectrum Regression On Ten Countries 1913 2016 Sciencedirect

Double Declining Depreciation Calculator Calculator Academy

8 Ways To Calculate Depreciation In Excel Journal Of Accountancy

Declining Balance Depreciation Double Entry Bookkeeping

Solved Asset Useful Depreciation Accumulated Depreciation Chegg Com

Lesson 7 Video 5 Declining Balance Switching To Straight Line Depreciation Method Youtube

How To Apply Declining Balance Depreciation Formula In Excel

Straight Line Depreciation Sum Of The Years Digits

Long Lived Tangible And Intangible Assets Ppt Download

4 Ways To Calculate Depreciation On Fixed Assets Wikihow

Free Depreciation Calculator Online 2 Free Calculations